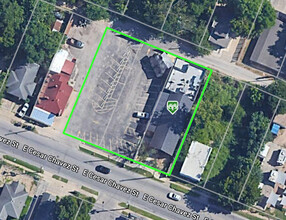

Michelin Recommended East Austin Restaurant 2708 E Cesar Chavez St 3,543 SF Retail Building Austin, TX 78702 £2,636,893 (£744.25/SF) 5.97% Net Initial Yield

INVESTMENT HIGHLIGHTS

- PRIME EAST AUSTIN LOCATION

- FINE DINING - MICHELIN RECOMMENDED

- 1.75% ANNUAL ESCALATIONS

- BLUE CHIP TENANT

- 5 YEAR LEASE + TWO 7 YEAR OPTIONS TO RENEW

- STRONG GUARANTEES

EXECUTIVE SUMMARY

The restaurant name was withheld for tenant privacy, but this East Austin Michelin-recommended restaurant is within Austin's pre-eminent hospitality group with accolades almost too numerous to mention. This is an investor opportunity, not owner/user, as the restaurant is highly successful in this location and is in their 3rd year of their initial 7-year lease, with two 7-year options to renew.

-

The group has an unprecedented 6 Michelin Awards including a Michelin Star awarded in 2024, Bon Appetit - Hot Ten Best New Restaurants, Robb Report - 10 Best New Restaurants In America, Esquire Magazine's 40 Best New Restaurants In America, Austin American Statesman Best Austin Restaurants 2018, Michelin Bib Gourmand Award For Sustainability, and more.

-

This award-winning East Austin restaurant is one of the Hospitality Group's 12 fine dining establishments, and in particular, since opening in early 2023, it's earned a 2024 Michelin Guide Recommendation, Texas Monthly Best New Restaurants, New York Times' Best Restaurants In Austin Right Now, and Texas Monthly - Best Places To Drink Wine In Austin.

-

Located in the Holly Street District, according to Time Out Magazine 2019, it's “one of the top 25 coolest neighborhoods in the world”. After a boom in food options and culinary creativity over the last decade, the area is known for an eclectic mix of local and international flavors and a diverse blend of casual eateries, trendy spots, cocktail bars, breweries, and hidden gems.

-

The ongoing development of mixed-use buildings along the César Chávez corridor continues to attract a range of tech startups, creative agencies, and independent businesses that support the local economy add to the area’s growing urban sophistication, create vibrant spaces for residents and visitors, and contribute to rising rents and property values.

-

Texas' business-friendly environment, lack of state corporate or income taxes, higher quality of life, and deep talent pool appeal to businesses considering moving to Austin. Job growth and company relocations continue to drive population growth ahead of any other major market in the country. Since 2010, Austin's population has outperformed the second-fastest-growing market, Raleigh, by more than 7.5%. The education and health services sector is expected to continue to see strong job growth and will be vital to serving one of the fastest-growing metros in the nation. Thanks to its younger demographic, Austin will likely outperform many of its peer markets. The young, highly educated workforce has attracted employers and delivered high-paying jobs, boosted the median household income to above the U.S. average, and contributed to the city's economic growth.

-

With 5 years remaining on the initial lease term at a strong average cap rate of 5.97%, strong guarantees, and an award-winning restaurant that is here to stay, look forward to a 6.63% average cap rate during the first 7-year renewal period, and an even stronger 7.48% cap rate in the second 7-year renewal term, subject to tenant renewal.

-

The photos and the virtual tour were created prior to the current tenant taking possession of the property. We do have current photography and can provide that upon request to interested parties.

-

All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to the accuracy of any description. All measurements and square footage are approximate. Nothing herein shall be construed as legal, accounting, or other professional advice outside the realm of real estate brokerage.

-

The group has an unprecedented 6 Michelin Awards including a Michelin Star awarded in 2024, Bon Appetit - Hot Ten Best New Restaurants, Robb Report - 10 Best New Restaurants In America, Esquire Magazine's 40 Best New Restaurants In America, Austin American Statesman Best Austin Restaurants 2018, Michelin Bib Gourmand Award For Sustainability, and more.

-

This award-winning East Austin restaurant is one of the Hospitality Group's 12 fine dining establishments, and in particular, since opening in early 2023, it's earned a 2024 Michelin Guide Recommendation, Texas Monthly Best New Restaurants, New York Times' Best Restaurants In Austin Right Now, and Texas Monthly - Best Places To Drink Wine In Austin.

-

Located in the Holly Street District, according to Time Out Magazine 2019, it's “one of the top 25 coolest neighborhoods in the world”. After a boom in food options and culinary creativity over the last decade, the area is known for an eclectic mix of local and international flavors and a diverse blend of casual eateries, trendy spots, cocktail bars, breweries, and hidden gems.

-

The ongoing development of mixed-use buildings along the César Chávez corridor continues to attract a range of tech startups, creative agencies, and independent businesses that support the local economy add to the area’s growing urban sophistication, create vibrant spaces for residents and visitors, and contribute to rising rents and property values.

-

Texas' business-friendly environment, lack of state corporate or income taxes, higher quality of life, and deep talent pool appeal to businesses considering moving to Austin. Job growth and company relocations continue to drive population growth ahead of any other major market in the country. Since 2010, Austin's population has outperformed the second-fastest-growing market, Raleigh, by more than 7.5%. The education and health services sector is expected to continue to see strong job growth and will be vital to serving one of the fastest-growing metros in the nation. Thanks to its younger demographic, Austin will likely outperform many of its peer markets. The young, highly educated workforce has attracted employers and delivered high-paying jobs, boosted the median household income to above the U.S. average, and contributed to the city's economic growth.

-

With 5 years remaining on the initial lease term at a strong average cap rate of 5.97%, strong guarantees, and an award-winning restaurant that is here to stay, look forward to a 6.63% average cap rate during the first 7-year renewal period, and an even stronger 7.48% cap rate in the second 7-year renewal term, subject to tenant renewal.

-

The photos and the virtual tour were created prior to the current tenant taking possession of the property. We do have current photography and can provide that upon request to interested parties.

-

All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to the accuracy of any description. All measurements and square footage are approximate. Nothing herein shall be construed as legal, accounting, or other professional advice outside the realm of real estate brokerage.

PROPERTY FACTS

Sale Type

Investment NNN

Property Type

Retail

Property Subtype

Restaurant

Building Size

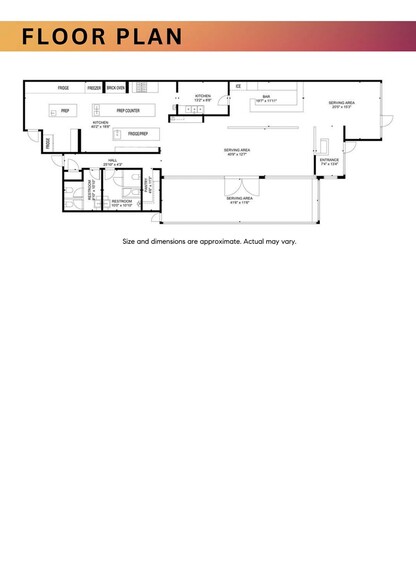

3,543 SF

Building Class

B

Year Built/Renovated

2017/2022

Price

£2,636,893

Price Per SF

£744.25

Net Initial Yield

5.97%

NOI

£157,422

Tenancy

Single

Number of Floors

1

Building FAR

0.21

Lot Size

0.39 AC

Zoning

commercial - CS-CO-MU-NP

Parking

28 Spaces (7.9 Spaces per 1,000 SF Leased)

Frontage

131 ft on E Cesar Chavez St

AMENITIES

- Courtyard

- Pylon Sign

- Restaurant

- Signage

- Tenant Controlled Heating

- Wheelchair Accessible

- Air Conditioning

- Smoke Detector

MAJOR TENANTS Click Here to Access

- TENANT

- INDUSTRY

- SF OCCUPIED

- RENT/SF

- LEASE TYPE

- LEASE END

- Withheld

- Accommodation and Food Services

-

99,999 SF

-

$9.99

-

Lorem Ipsum

-

Jan 0000

| TENANT | INDUSTRY | SF OCCUPIED | RENT/SF | LEASE TYPE | LEASE END | |

| Withheld | Accommodation and Food Services | 99,999 SF | $9.99 | Lorem Ipsum | Jan 0000 |

Walk Score®

Very Walkable (83)

Bike Score®

Biker's Paradise (98)

NEARBY MAJOR RETAILERS

PROPERTY TAXES

| Parcel Numbers | Improvements Assessment | £133,903 | |

| Land Assessment | £1,586,660 | Total Assessment | £1,720,563 |