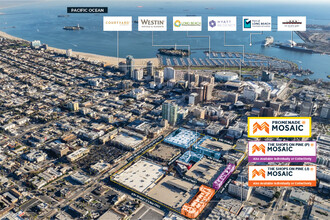

Promenade @ Mosaic 300-325 The Promenade N 115,271 SF 81% Leased 4-Star Retail Building Long Beach, CA 90802 £26,119,626 (£226.59/SF) 6.65% Net Initial Yield

INVESTMENT HIGHLIGHTS

- Dominant Multi-Building Portion – Promenade @ Mosaic is the most dominant retail portion in the Mosaic district and trade area

- Well Below Market Rents – Rents are well below market levels – approximately 16% below market

- Value-Add Opportunity with Significant Upside Potential

EXECUTIVE SUMMARY

* Dominant Multi-Building Portion – Promenade @ Mosaic is the most dominant retail portion in the Mosaic district and trade area given its size, tenancy, configuration, and location on three city blocks and four streets – Long Beach Boulevard, The Promenade, 3rd Street, and 4th Street

* Value-Add Opportunity with Significant Upside Potential – At ±81% occupancy and given Ross Dress for Less’s significantly below market rent, this portion presents a legitimate short- and long-term value-add opportunity through vacant space lease-up and rolling Ross’s significantly below market rent to market levels

* Well Below Market Rents – Rents are well below market levels – approximately 16% below market property-wide and Ross’s rent more significantly under market than that at approximately 64% below market

* Significant Income Growth – Through lease-up of vacant space, embedded rental increases, and rolling below-market rents to market levels, the NOI is projected to substantially improve

*The NOI is projected to grow by more than $1,345,000 (58%) upon stabilization (Year 3) and more than $2,901,000 (125%) over the anticipated 10-year hold period with a

CAGR of ±8.5%

*Assuming 100% occupancy at market rents including Ross’s rent, a Pro Forma NOI could exceed $8,500,000 – a 22%+ cap rate based on the current offering/list price

* Value-Add Opportunity with Significant Upside Potential – At ±81% occupancy and given Ross Dress for Less’s significantly below market rent, this portion presents a legitimate short- and long-term value-add opportunity through vacant space lease-up and rolling Ross’s significantly below market rent to market levels

* Well Below Market Rents – Rents are well below market levels – approximately 16% below market property-wide and Ross’s rent more significantly under market than that at approximately 64% below market

* Significant Income Growth – Through lease-up of vacant space, embedded rental increases, and rolling below-market rents to market levels, the NOI is projected to substantially improve

*The NOI is projected to grow by more than $1,345,000 (58%) upon stabilization (Year 3) and more than $2,901,000 (125%) over the anticipated 10-year hold period with a

CAGR of ±8.5%

*Assuming 100% occupancy at market rents including Ross’s rent, a Pro Forma NOI could exceed $8,500,000 – a 22%+ cap rate based on the current offering/list price

PROPERTY FACTS

Sale Type

Investment

Property Type

Retail

Property Subtype

Retail

Building Size

115,271 SF

Building Class

A

LoopNet Rating

4 Star

Year Built

2002

Price

£26,119,626

Price Per SF

£226.59

Net Initial Yield

6.65%

NOI

£1,736,955

Percent Leased

81%

Tenancy

Multiple

Number of Floors

1

Loading Docks

1 Exterior

Building FAR

0.73

Lot Size

3.65 AC

Opportunity Zone

Yes

Zoning

LBPD30 - Downtown Long Beach

Frontage

AMENITIES

- Corner Lot

- Dedicated Turning Lane

- Signage

- Signalised Junction

Walk Score®

Walker's Paradise (98)

Transit Score®

Excellent Transit (75)

Bike Score®

Biker's Paradise (90)

NEARBY MAJOR RETAILERS

PROPERTY TAXES

| Parcel Numbers | Improvements Assessment | £4,972,976 | |

| Land Assessment | £10,921,362 | Total Assessment | £15,894,338 |