3 Approaches to Repurposing Shopping Centres

As the UK retail sector continues to recover from effects of the COVID-19 pandemic and amid an ongoing cost-of-living crisis, both tenants and owners are adapting to changes in how people live, work and shop.

Shopping centres in particular have been affected by the changes in retail more than any other part of the sector, leading to below-market sales and reduced construction starts. Shopping centre vacancy sat at 6.2% in the first quarter of 2023, more than double the national retail average of 3%, according to data from LoopNet publisher CoStar. Likewise, average shopping centre sale prices dropped at the beginning of the year to US$86, or £69.74, per square foot, their lowest rate since Q1 2021.

"I think part of the problem with the UK retail sector is that there was too much building done in recent decades," said Mark Stansfield, senior director of market analytics at CoStar UK, in an interview with LoopNet. "So, when e-commerce came in, it became clear that portfolios didn't need to be that big, and that led to a lot of consolidation and switching to multi-channel."

David Fox, co-head of retail agency at Colliers International, agrees with Stansfield's assessment, adding that some shopping centres in the less affluent, post-industrial areas of the country are struggling to remain cash-positive, in large part due to out of date construction.

"Most of those shopping centres that were built during our boom in the 80s, 90s and 00s are no longer fit for overall purpose," Fox told LoopNet. "They've ceased to be viable as shopping centres."

With so much space sitting vacant and appearing increasingly likely to remain that way, many owners of underperforming shopping centres are turning to new uses to try to bring their assets back to life.

In general, their efforts can be divided into three different approaches:

- Revitalise.

- Reimagine.

- Replace.

Revitalise

For landlords whose shopping centres are only facing partial vacancy, full-scale redevelopment is rarely necessary, especially if their anchor tenants are still in place.

"If you've got a supermarket and you can retain your supermarket, but the smaller shops aren't leasing," Fox said, "then frankly, you can repurpose those relatively easily."

In the short term, he said, owners can fit out empty shops on spec, so future tenants don't have to spend large amounts of capital at the beginning of their lease. This approach gives tenants more incentive to rent space while also allowing owners to offer more flexible leasing options.

"But it also means you have to design something that will fit many different purposes," Fox added. "So, that if they do move out, you're not having to start again."

Stansfield underscored the importance of finding the right mix of tenants, and "maybe not taking the highest rent available, but just creating that mix to make sure that shoppers come back in big numbers and that the centre gets revitalised."

"It isn't always about finding the highest-quality tenant," Fox agreed. "It's about finding the right tenant."

In many cases, owners turn to experiential and leisure tenants to draw more footfall to their property. One noteworthy example is the former Debenhams store in Wandsworth being let to Gravity Entertainment, which features climbing walls, electric go-karts and trampolining. Fox also mentioned mini golf, ping pong, darts and bowling among other leisure offerings he's seen pop up in UK shopping centres.

And while many major cinema chains have been dealing with reduced traffic coming out of the pandemic, Fox said that "there are still quite a number of smaller, independent cinema operators out there taking smaller screens and perhaps not opening seven days a week."

However, Fox also added a caveat to the leisure approach, noting that "the leisure market is in a bit of a flux. We're seeing quite a lot of growth [in experiential leisure] at the moment. But where we're seeing casualties is in the casual dining market."

"It's not just about sitting in a cinema and then going for something to eat," Fox said. "People want a full leisure experience."

Reimagine

For shopping centres facing high vacancy rates or that have lost an anchor tenant, owners often have little choice but to fully reimagine their asset.

"If you lose an anchor tenant," Fox said, "the first question to ask yourself is, 'Can I replace it?' And if you can replace it, is what you replace it with going to be viable, or are you going to end up in the same place in the next cycle?"

When replacing an anchor tenant is not a viable option, some sort of change in use class will likely be unavoidable. In some cases - such as the above-mentioned Gravity location - that means fitting out space for a new type of tenant while retaining some amount of traditional retail space elsewhere in the centre.

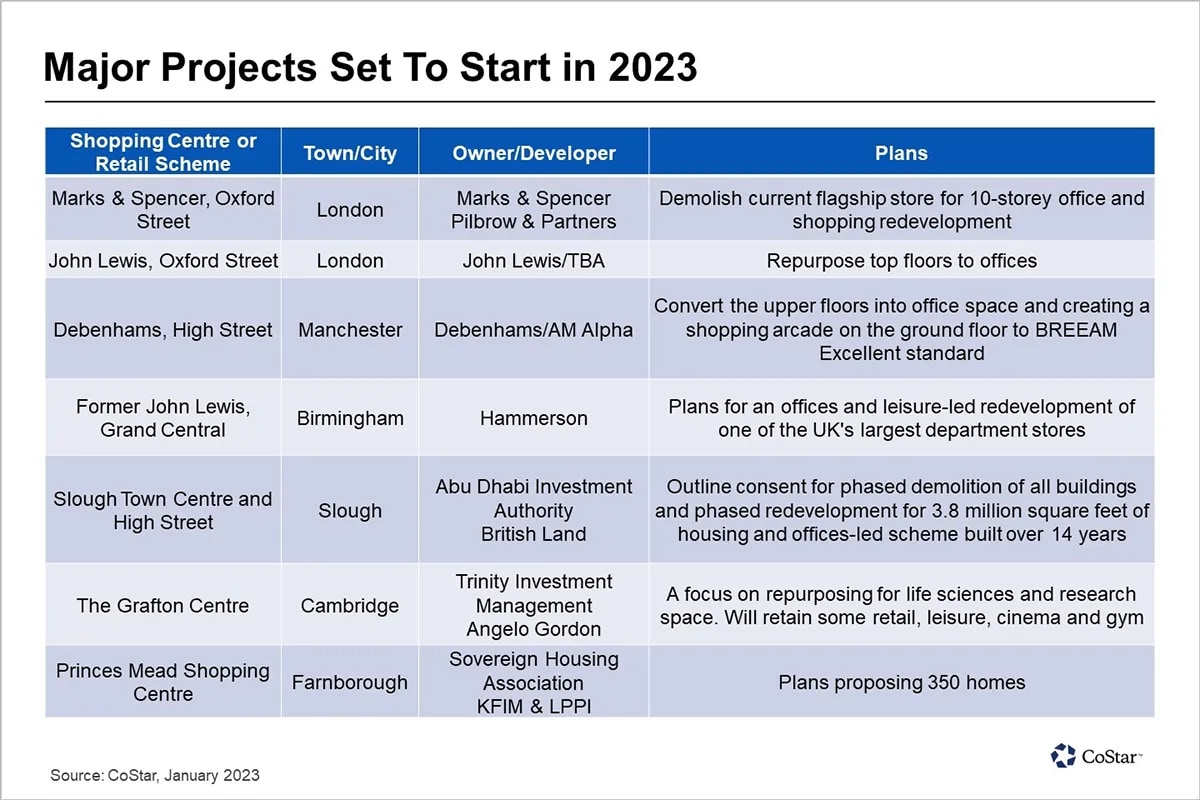

Another common use being explored by shopping centre owners is office, with the former John Lewis in Birmingham, which has been sitting empty for over three years, notably slated to be reimagined as 200,000 square feet of sleek new offices later this year.

A similar scheme is underway for the Grade II listed Rylands Building in Manchester, where a four-storey extension would contribute to nearly 300,000 square feet of offices above a shopping and leisure arcade.

The Grafton Centre in Cambridge, meanwhile, will see the former Debenhams demolished to deliver new life sciences research space while retaining some retail space, as well as the existing cinema and gym.

In other cases, owners are turning to the residential sector to generate extra rental income while also bringing in more footfall to their retail offerings. For example, real estate developer Redevco is seeking to transform Templars Square in Cowley into a residential-led mixed-use scheme featuring 226 residential units.

"If you can build a business case around residential development and repurposing the ground floor for other commercial uses, it can still stack and it does stack," Fox said. He added that "it has to be a symbiotic relationship between what you build on the ground and [what you build] going up."

And while these kinds of major overhauls to a shopping centre's original use require significant capital expenditure, there exist a number of public funding options to supplement private investment, such as the Levelling Up Fund, the Towns Fund, the Public Works Loan Board and the Getting Building Fund.

For Stansfield, this approach is about "really reimagining the space and often working with proactive local councils to bring these assets back to life."

Replace

According to Fox, shopping centres that have been sitting empty for years in markets with a significant oversupply of retail space are unlikely to ever secure viable tenants again. Referring to the three most important characteristics of a retail asset - location, location and location - Fox said that "if it's not in the right place, you're not going to be able to let it."

You've then got the piece of land and you can go into planning and design something that's fit for purpose when the economic picture allows it.

David Fox, co-head of retail agency, Colliers International

When shopping centres reach this level of consistent inoccupancy, they often become candidates for full-scale demolition and redevelopment. Fox said that while it may not be the most attractive approach for beleaguered shopping centre owners, it is often the one that makes the most financial sense, particularly "if they're costing you a service charge that you're not seeing a return from, or if it's a constant turnover of tenants and you're never seeing any real income."

And although demolition does come with its own set of costs, it opens up the possibility for owners to make the best use of their underlying asset: land.

"You've then got the piece of land," Fox said. "And you can go into planning and design something that's fit for purpose when the economic picture allows it. That's when you get to the fundamental question of 'What would you build if you had this piece of land today?'"

One answer to that question can be found in Slough, where a massive housing and offices-led scheme in the town centre is set to offer up to 3.78 million square feet of commercial and residential space across six development zones, including up to 1,600 new homes, 15,000 square metres of flexible town centre spaces for shops, restaurants, community, leisure and education facilities and up to 40,000 square metres of offices. Public spaces, including a new town square, an urban park, a local square and landscaped "community heart" space are also planned.