What is Rental Yield in Commercial Property Investing?

To the layperson, commercial buildings are often about location, architecture and design as well as vibrancy and excitement. While these elements certainly contribute to the value of a property, to an investor, the income stream from rent paid by tenants is at the heart of a building's value.

To understand the strength or weakness of an asset's income stream relative to similar buildings in the market, investors calculate a property's rental yield. This assessment is typically made early on when investors are considering the purchase or financing of a real estate asset.

To understand how to calculate property yield and the role it plays in valuation, this article looks at four key components of the metric:

- What is rental yield?

- Gross rental yield versus net rental yield.

- Including debt and capital expenditures in net rental yield.

- Why investors focus on rental yield.

1. What is Rental Yield?

One way to get an indication of a property's return on investment - from rent collected, as opposed to appreciation over time - is to calculate its rental yield. Also referred to as property yield, this is a relatively simple calculation that generates a percentage figure reflecting the rental income expected to be collected in the first year of ownership compared to the value of the property.

This metric is akin to the dividend yield one receives from a bond, according to Colin Lizieri, Emeritus Fellow of Pembroke College at the University of Cambridge, adding that "it indicates the income return an investor will receive over the coming year from owning the property."

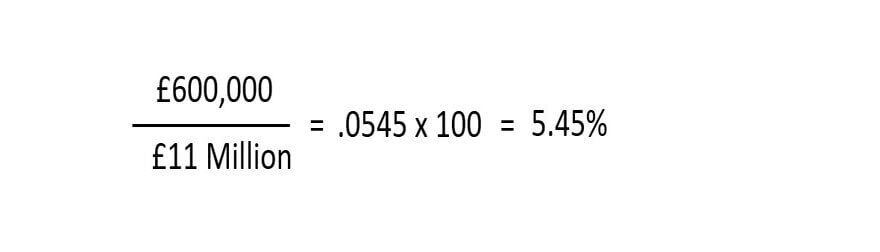

Rental yield is typically generated by dividing the estimated rental income in the first year of ownership by the asking price of the asset, and then multiplying that result by 100.

For example, an office building selling for £11 million with rental income of £600,000 generates a rental yield of 5.45%.

The term rental yield is often used as shorthand when referring to the metric, but it is important to specify if one means gross or net rental yield.

2. Gross Rental Yield Versus Net Rental Yield

While the rental yield equation is fairly straightforward, it's important to bear in mind that there are three primary ways that rental income can be determined.

- Gross rental income: provides insight into the rental income stream without subtracting any of the expenses an owner will incur in owning and operating the property.

- Net rental income: calculated by subtracting typical operating expenses, like management and brokerage fees, insurance, utilities, property taxes and routine maintenance and repair costs, from the rental stream. Some investors also subtract operating expenses, as well as some portion of capital expenses, further eroding the net rental stream.

- Levered net rental yield: produced by including debt costs in addition to operating expenses and capital costs.

The three examples below show that by including or excluding certain costs from the rental income figure, rental yield can vary significantly.

- In the above example of the building priced at £11 million, expenses were not deducted from rental income, resulting in a gross rental yield of 5.45%.

- If typical operating expense for the property were £100,000, the net rental yield would be lower than the gross yield at 4.55% (£500,000 divided by £11 million).

- If capital expenditures and/or debt costs totalled £150,000 and were subtracted along with the typical operating expense for the property, the levered net rental yield would be even lower at 3.18% (£350,000 divided by £11 million).

While deducting costs from rental income is a conservative and seemingly prudent thing to do, most investors begin with a gross calculation. Chris Urwin, founder of Real Global Advantage, a platform promoting sound investment decisions in global real estate, said that gross rental yield is probably the least beneficial of the metrics, but it's also the easiest to calculate, especially if an investor has limited information about the building's actual revenue and expense figures.

"Gross rental yield is typically available at an earlier stage of the process, before you've done any significant underwriting," he said. Urwin added that "the gross yield may well feature in a brochure or an initial introduction about a property, whereas understanding the net yield, including a subtraction for the cost of debt, is not something that somebody's going to be able to do immediately."

3. Including Debt and Capital Expenditures in Net Yield

Debt. Concerning the subtraction of debt costs from the gross rental stream, Urwin said that in the UK and Europe, "people often have an initial conversation about the net yield, on an unlevered basis. Perhaps, rightly or wrongly, there's a separation of the discussion about whether the deal makes sense on an equity basis. [That conversation alone] might not result in an optimal decision, but there's an evaluation of whether the deal looks attractive on an equity basis."

He said that as an assessment of the deal continues, debt is added to the conversation later, generating a levered rental yield figure. This is done in part because the cost of debt can vary significantly among investors.

Lizieri concurred, noting that "these are two separate decisions. One is, 'does this make sense as an investment on its own?', and the other is, 'how do I finance it?'"

Lizieri added that "if you are a private investor, not necessarily a high-net-worth investor, you're not going to buy a house to rent without thinking about borrowing, and whether you can pay the mortgage out of the yield. So, it's going to be an important part of your investment thought process."

But the issue comes when you are using the rental yield comparatively across buildings, "because you are looking at properties that are being bought by different investors who will have different capital structures, different costs of debt and mortgages on different terms," Lizieri said. So, if you're using it comparatively, including the cost of debt in your calculations makes it challenging to generate a true apples-to-apples comparison between properties.

That being said, "as a responsible finance professional", Lizieri encourages investors to account for the cost of debt "because it's a legitimate cost that one will need to bear", in owning the property.

Capital Expenditures. Whether or not to include capital expenditures (cap ex) raises similar issues. Urwin noted that capital expenditures - for long-term improvements like replacing roofs or updating lobbies - are not typically subtracted from the income stream "because some people might claim that there's [already] a degree of cap ex captured in net operating income, related to maintenance, for example. But generally, cap ex isn't in those yield numbers and, if it is, it is generally underestimated."

Urwin encourages investors to pay more attention to cap ex considerations, because "cap ex often doesn't feature sufficiently in the discussion."

Get Clarity. Lizieri emphasised that people need to be clear about whether they are basing their evaluations on a gross or a net yield. He gave the example of agents selling high-end residential properties in prime London locations that publish rental yields in listings but fail to indicate if they are gross or net.

"It can be disastrous if you applied a net yield to gross income because you'd end up with a value which would be way higher than you should be paying," Lizieri said.

And if the rental yield is a net number, dig deeper and get clarity about the expenses that were, or were not, subtracted from the rental stream.

4. Why Investors Focus on Rental Yield

Real estate investors invest for a variety of reasons. Some are drawn to properties for their income stream and others invest primarily for growth. For investors focusing on income, rental yield plays a significant role in their decision to purchase an asset.

Urwin said that "many real estate investors, especially those focusing on core and core plus assets, are primarily focused on real estate because it delivers a stable income." He continued that it's the income credentials of the property that they are focusing on because "the income producing credentials of the asset class are one of the intrinsic attractions."

To examine the income producing component of the investment, "it makes sense for [investors] to look at the yield", to determine the amount of income they will get back on the capital they put in.

This calculation is also attractive to investors for other reasons. For example, calculating rental yield enables them to quickly and easily ascertain if the asking price of an asset aligns with current market prices. The metric can also help investors determine if they are getting enough yield above the risk-free rate - proxied by UK Government bonds or "gilts" - to justify the purchase of a risky real estate asset.

Additionally, investors often use this metric to calculate a "terminal" rental yield so they can easily estimate a potential resale price for the asset at some point in the future and determine if that price represents enough profit to justify buying the asset today.